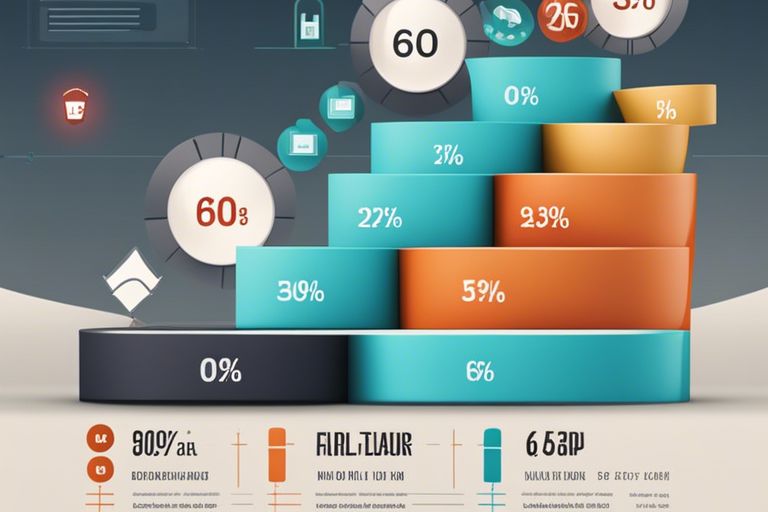

Many of us strive to manage our finances wisely, but have you heard of the 60-20-20 rule, based on the Pareto Principle? This principle suggests allocating 60% of your income to living expenses, 20% to savings, and 20% to debt repayment or investments. By following this rule, you can prioritize saving and secure your financial future. Let’s investigate how this principle can help you achieve your savings goals and build a stable financial foundation.

Key Takeaways:

- The Pareto Principle: Also known as the 80-20 rule, it states that 80% of results come from 20% of causes, emphasizing the idea of focusing on the most crucial inputs for maximum output.

- 60-20-20 Rule for Savings: This rule suggests dividing your income into three categories: 60% for expenses, 20% for savings, and 20% for debt repayment or investments. This helps in maintaining a balanced financial plan.

- Focus on Prioritizing Savings: By allocating a specific percentage of your income towards savings, you create a financial buffer for emergencies, future goals, and overall financial security, following the principle of prioritizing long-term wealth accumulation.

The Pareto Principle

Definition and Origin

For decades, the Pareto Principle has been a guiding force in various aspects of life, including economics and personal finance. Named after the Italian economist Vilfredo Pareto, this principle is based on the observation that roughly 80% of effects come from 20% of the causes. In the late 19th century, Pareto noted this unequal relationship while studying patterns of wealth and income in society.

The 80/20 Rule

Rule: In the matter of your finances, applying the 80/20 rule can be transformative. This means that around 80% of your savings can come from 20% of your efforts or expenses. By identifying and focusing on the most impactful areas, you can maximize your savings potential without overhauling your entire financial strategy.

To optimize your savings using the 80/20 rule, take a closer look at where your money is going. Identify the 20% of expenses that are contributing to 80% of your financial leaks. By cutting back or optimizing these areas, you can free up more resources to boost your savings and work towards your financial goals.

Applying the Pareto Principle to Savings

The 60-20-20 Rule

There’s a popular budgeting strategy known as the 60-20-20 rule that applies the Pareto Principle to your savings plan. This rule suggests that you allocate 60% of your income towards necessities, 20% towards savings, and the remaining 20% towards discretionary spending.

An effective way to implement this rule is by automating your savings. By setting up automatic transfers from your checking account to your savings account, you ensure that you consistently set aside a portion of your income towards your financial goals.

Breaking Down the Ratio

Rule: Breaking down the 60-20-20 ratio, you can see how the Pareto Principle comes into play. By prioritizing crucial expenses at 60%, you ensure that the majority of your income goes towards maintaining your basic needs. The 20% allocated for savings allows you to build a financial cushion and work towards your long-term goals, following the principle that 20% of your efforts lead to 80% of your results.

For instance, by consistently saving 20% of your income, you can steadily grow your emergency fund, save for major expenses like a home or car, or invest for retirement. This disciplined approach to saving ensures that you are financially prepared for unexpected events and future milestones.

The 60% for Necessities

Unlike the traditional 80/20 rule, which suggests that 80% of your outcomes come from 20% of your inputs, the 60:30:10 is the New 80/20 Rule proposed by economist Richard Koch. According to Koch, this principle advocates dividing your finances into 60% for necessities, 30% for discretionary spending, and 10% for savings. This concept emphasizes the importance of covering vital expenses before allocating funds to other areas of your budget. To learn more about this approach, you can read the article on 60:30:10 is the New 80/20 Rule.

Essential Expenses

The first 60% of your income should be dedicated to vital expenses. These include bills such as rent or mortgage, utilities, groceries, transportation costs, insurance premiums, and other necessary payments. By prioritizing these expenses, you ensure that your basic needs are met before exploring discretionary spending or saving options.

Prioritizing Needs over Wants

Essential expenses should always take precedence over discretionary spending. While it’s tempting to indulge in wants like dining out frequently, shopping for non-vital items, or upgrading to the latest tech gadgets, it’s crucial to distinguish between needs and wants to maintain financial stability. By prioritizing your needs over your wants, you establish a strong foundation for your budget and prevent overspending on items that are not imperative to your well-being.

This approach helps you develop financial discipline and cultivate a habit of responsible money management. By consistently prioritizing needs over wants, you can build a secure financial future and achieve your savings goals with greater ease.

The 20% for Savings and Debt Repayment

Building an Emergency Fund

Your first priority in allocating the 20% of your income for savings and debt repayment should be to build an emergency fund. Having an emergency fund is crucial for unexpected expenses like medical emergencies, car repairs, or sudden job loss. Aim to save at least three to six months’ worth of living expenses in this fund to ensure you are financially prepared for any unforeseen circumstances that may arise.

Paying Off High-Interest Debts

High-interest debts, such as credit card balances or payday loans, can quickly accumulate and become a significant financial burden. Allocating a portion of the 20% towards paying off these debts is important to avoid sinking further into debt due to compounding interest. Prioritize paying off high-interest debts first to free yourself from costly obligations and improve your financial health in the long run.

Emergency funds are like financial safety nets, providing you with peace of mind and a sense of security knowing that you have a financial cushion to rely on in times of need. By focusing on building an emergency fund and paying off high-interest debts, you are setting yourself up for financial stability and paving the way towards achieving your long-term financial goals.

The 20% for Discretionary Spending

Enjoying Guilt-Free Spending

To truly embrace the 60-20-20 rule for savings, you need to allocate 20% of your income towards discretionary spending. This portion of your budget is your guilt-free zone, where you can indulge in the things that bring you joy and fulfillment. Whether it’s dining out at your favorite restaurant, treating yourself to a spa day, or splurging on a new gadget, this 20% is meant to enhance your quality of life.

Investing in Personal Growth

An crucial aspect of the 20% discretionary spending allocation is investing in your personal growth. This can include enrolling in courses or workshops to expand your knowledge and skills, attending conferences to network and learn from industry experts, or signing up for that gym membership to prioritize your health and well-being. By dedicating a portion of your budget to personal development, you are investing in yourself and laying the foundation for future success.

Growth in any aspect of your life, whether professional, personal, or emotional, requires continuous learning and self-improvement. By earmarking a portion of your income for activities that foster personal growth, you are actively investing in becoming the best version of yourself. This not only benefits you in the present but also sets you up for long-term fulfillment and success.

Benefits of the 60-20-20 Rule

Many financial experts advocate for the 60-20-20 rule as it provides a simple and effective framework for managing your finances. By allocating 60% of your income to expenses, 20% to savings, and 20% to debt repayment or investments, you can streamline your financial decisions and prioritize your long-term goals.

Simplifying Financial Decisions

On top of providing a clear guideline for your finances, the 60-20-20 rule can also simplify your financial decisions. Instead of agonizing over where to allocate your money each month, you can simply follow the rule and trust that you are moving towards financial stability and security. This structure can help you avoid impulse spending and focus on building your savings and reducing debt systematically.

Achieving Long-Term Goals

The 60-20-20 rule is particularly beneficial for achieving long-term financial goals. By consistently setting aside 20% of your income for savings and investments, you are laying the groundwork for a secure financial future. Whether your goal is to buy a home, retire early, or start a business, following this rule ensures that you are actively working towards your aspirations and not just living paycheck to paycheck.

Simplifying your financial strategy with the 60-20-20 rule allows you to have a clear roadmap for your financial future. By prioritizing saving and debt repayment, you are setting yourself up for long-term financial success and stability.

Conclusion

Hence, understanding the Pareto Principle in the 60-20-20 rule for savings can help you prioritize and optimize your financial decisions. By focusing on the most crucial 20% that will yield 80% of the results, you can effectively allocate your income towards savings, investments, and expenditures. Bear in mind, the key is to strike a balance between saving for the future and enjoying the present, ensuring financial stability and long-term growth.

So, as you navigate your financial journey, keep the 60-20-20 rule in mind to make informed choices that align with your goals and aspirations. By harnessing the power of the Pareto Principle, you can take control of your finances, build wealth steadily, and secure a brighter future for yourself and your loved ones.

Q: What is the Pareto Principle in the 60-20-20 Rule for Savings?

A: The Pareto Principle, also known as the 80/20 rule, suggests that roughly 80% of your outcomes result from 20% of your efforts. In the context of the 60-20-20 rule for savings, this means that 80% of your financial progress can come from focusing on the most impactful 20% of your saving and spending decisions.

Q: How does the 60-20-20 Rule for Savings work?

A: The 60-20-20 rule for savings is a simplified budgeting strategy where you allocate 60% of your income to fixed expenses, 20% to savings, and 20% to discretionary spending. By following this rule, you ensure that you prioritize saving a significant portion of your income while still allowing yourself some room for flexible spending.

Q: What are the benefits of following the 60-20-20 Rule for Savings?

A: Following the 60-20-20 rule for savings can help you achieve financial stability and build wealth over time. By consistently saving 20% of your income, you can create an emergency fund, save for future goals, and invest for long-term growth. This rule also promotes mindful spending by limiting your discretionary expenses to 20% of your income.